1. Showboating

In my little middle to upper middle class circle there are persons who pop bottles and persons who will only buy 2 drinks. There are persons who drive Toyotas and persons who drive BMWs. Persons who wear Gucci and persons who couldn’t imagine spending $200 on any article of clothing. in every scenario you will find that it is the person who has the most who spends the least. Islanders are very big on achievement and success. We more or less grow up in modern day caste systems where the ones with the money and notoriety receive the best. As such, those who don’t have it are  inclined to take steps to give the impression they do. So when you see them out a road they are stepping out of their Mercedes, only to be parking it in front of their mom’s apartment. That’s showboating (not in its literal sense of course).

inclined to take steps to give the impression they do. So when you see them out a road they are stepping out of their Mercedes, only to be parking it in front of their mom’s apartment. That’s showboating (not in its literal sense of course).

I get paid hourly. Most every time I make a major purchase (anything over 100) I pin the cost of the item/service against how much I make per hour. It always straightens me out. Let’s say u make $10 an hour. Asking yourself if 1 bottle of Belvedere is worth 10 hrs of your labour (to make someone else even more money) tends to mend a poor decision.

2. Saving

Being able to put money aside is essential for the island parent. He or she has passed this on tirelessly to their children. “You need fi make sure yuh puddown yuh money.” Saving a marginal percentage of every dollar (experts suggest at least 7%) is important. But beyond that we should be thinking about planning for retirement and the ways in which we can put a significant amount of our earnings to work for us. Taking risks with our hard earned money is not at the top of the islanders priorities, especially for those of us whose pay checks are more or less fully accounted for. But investing is just as important as saving. All saving will ever allow you to do is pay for things. Investing puts you in a position to go far beyond that.

3. Cookie cutter ideas of success

As islanders we tend to have cookie cutter ideas of success. This more or less boils down to going to school, graduating, and getting get a good job. We tend to applaud the person who exclaims, “I got the job!” then look side-eyed at the one who shouts, “I want to start my own business.” For some reason book smarts are applauded more than street smarts and technical skills aren’t valued nearly as much as the didactic. Today, more than ever, persons are able to attain success and wealth in ways we never imagined. We are approaching a time when those with the so-called book smarts don’t have nearly as much earning power as those with creativity and skill. Our cookie cutter ideas can often hold us back from the greatness of our potential. When we stop buying into other peoples ideas of success, doors begun to open and wealth becomes less elusive.

4. Pride

Pride has gotten in the way of many opportunities and life lessons for all of us, heritage aside. In Robert Kiyosaki’s “Rich dad, Poor dad,” he comments on the ways in which our culture and broughtupcy impact our views on money, and subsequently or journey to wealth. When I just moved here (at 15) I wanted to get a job at Wendy’s, but my mom wouldn’t have that. No child of hers would be working in a fast food restaurant. Why? Because of pride. She couldn’t move a farrin and have her good good UPT pickney a work a Wendy’s.The sooner we learn to earn our own way, the sooner we learn to manage our funds. Pride can also become institutional, to the point that a man who has lost a great job, will be psychologically unable to do whatever it takes to help is family because he is too ashamed to assume a role that may be deemed lesser than the one he previously held.

5. A never evolving circle

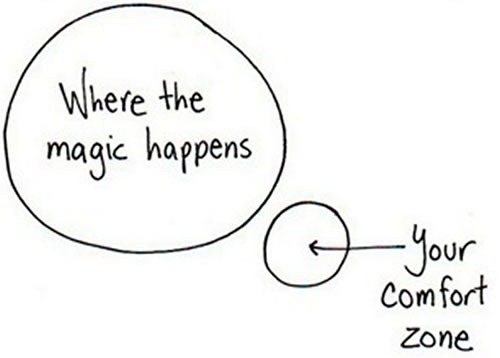

A lot of islanders are loyal to a fault. Once you have us, you have us; and that’s pretty awesome. You will meet a yute at 15 and he’s rolling wid the same dudes at 30. That’s great, if you are all more or less on a progressive journey. If not, then without recognizing it we can be held back. For those who are doing better than the average joe in your circle it can also foster a sense of complacency. If everyone you know lives with their parents and you mortgage your home, then you may become unwarrantedly comfortable with your progress. You will never learn or evolve going to the same places, doing the same things, with the same people. Growth begins outside of your comfort zone. You have to position yourself around success in order to both emulate and eventually embody it.

A lot of islanders are loyal to a fault. Once you have us, you have us; and that’s pretty awesome. You will meet a yute at 15 and he’s rolling wid the same dudes at 30. That’s great, if you are all more or less on a progressive journey. If not, then without recognizing it we can be held back. For those who are doing better than the average joe in your circle it can also foster a sense of complacency. If everyone you know lives with their parents and you mortgage your home, then you may become unwarrantedly comfortable with your progress. You will never learn or evolve going to the same places, doing the same things, with the same people. Growth begins outside of your comfort zone. You have to position yourself around success in order to both emulate and eventually embody it.

6. Get lost in affiliation versus seeking mentorship

Island people like to be affiliated wid di real big man. They may get an unwarranted sense of importance being able to say I know so and so; air kissing them in social settings and pal-offing with their “toys.” That’s all well and good but affiliation is not networking. It does not bring wealth. If increasing your earning potential is not on your agenda, then that’s fine. Enjoy your Saturdays on their yacht. But if it is, then be sure that you are having meaningful life changing conversations and seeking mentorship. All it takes is an interest beyond what he or she can immediately do for you. Instead of begging a free ticket, offer to help with the set up. Volunteering your services and learning from the way they grow their own wealth can help you pick up invaluable gems and tools that will no doubt be far more priceless than a free ticket.

7. Unwilling to spend

Islanders grow up with a third world mentality. Most of us, even if we were able to enjoy more than comfortable lives, have no concept of first world privilege. The kind of privilege that makes it much easier to take risks with our hard earned money. In addition, credit structures don’t exist in many islands so we learn that if we don’t have the cash we simply can’t afford it. Accumulation of good debt is hard to decipher from the bad. There is no putting it on our credit cards, pay day loans or swarms of debt to meet immediate needs. The down side to this, is that when we take the plunge to do our own thing we tend to waste a lot of time and resources doing things that slow or take away from our progress. All because we are unwilling to pay. Afterall, ….mi can do it miself, so wah mi a pay him for. In Ricky Yean’s provocative article, he touches on this topic and how our third world broughtupcy truly impacts our business sense.

8. Not thinking about money

Money is the root of all evil. Tony Robbins (in his book, “Money:Master the game”) tells the story of how a girl-friend of his found the discussion and overt concern regarding wealth-building very unbecoming as a Christian. This is something to which, I can totally relate. It seems very unchristian in  a way to be thinking about money “too much” or to have constant concern with the state of our wealth. The bible says however, that it is the love of money that is the root of all evil and not money itself. Tony offers that we hardly ever want money in its abundance. What we truly want is security and the other things money may provide for us and our families. If we don’t think about our money we are neglecting not just its growth but its sustenance. A plant wont live, let alone grow without being watered. You have to be deliberate in sewing and nurturing any seed from which you wish to reap. That does not equate to idolatry.

a way to be thinking about money “too much” or to have constant concern with the state of our wealth. The bible says however, that it is the love of money that is the root of all evil and not money itself. Tony offers that we hardly ever want money in its abundance. What we truly want is security and the other things money may provide for us and our families. If we don’t think about our money we are neglecting not just its growth but its sustenance. A plant wont live, let alone grow without being watered. You have to be deliberate in sewing and nurturing any seed from which you wish to reap. That does not equate to idolatry.

9. Them cyan badda (can’t be bothered)

Islanders cyan badda deal wid the people pon di phone. Dem cyan badda cancel the subscription after the trial. Them cyan badda spend the second it would take to Google a promo/coupon code. Them cyan badda fill out the long ass form fi enter the rewards program. Next month them will check them credit score. Tomorrow them will look into it. Not being bothered costs so much money. I once had a $12.99 subscription for prepaid legal for over 10 years, merely because the process of cancellation was purposely grueling. My intentions to get rid of it tomorrow, next week, next month began to add up. I wasn’t combing through my entire statement every month and so I didn’t too miss the $13. My cyaan badda attitude cost me $1559.

10. Not doing research

Being 1 step ahead of the game is great, until you find out that if you only did a little bit of research you could have been 10 steps ahead. True, research is time consuming and you have to first know where to start, before you can even consider looking into how far you can go. But it’s often as simple as saying, “Thanks for the information, I’ll get back to you.” And thereafter looking into other options. Do one better and simply type your area of uncertainty in Google. I began investing in stocks by simply searching for things like, “how do I invest in stocks?” “What questions should a first time investor ask?” “What are the best kinds of stocks for a first time investors?”

Once more, there are no absolutes. Some islanders are moguls, multiplying their wealth while they sleep.

For those of you who are not, I hope this list helps.